2022 Work From Home Tax Deductions

Table of Content

However, even if you’re not one of these, there are still a few possible ways for you to get tax deductions from your expense for working from home. A financial advisor can help you find every deduction and credit you are entitled to. If you use the home as a residence and as a rental property, you'll have to divide the costs between the times it’s used as either personal or business when you file taxes. For example, if the home is used by your family for more than 10% of the number of days that it's rented, then it's considered a residence and rental costs can’t be deducted from your taxes. If you use the home as a residence and rent it for 15 days or more, report the rental income. You can deduct your interest and taxes as described above.

For example, if you rented your home out for 30 days and also used it personally for 10 days, then the house was used for 40 days. You don't have to report the rental income as long as the home wasn't rented out for more than 14 days. A second home is considered an investment property if you rent it out for more than 14 days in a year. It doesn’t matter how much rental income you earn in this period. In fact, you don’t have to claim rental income if you’re renting the property for 14 days or less.

Usually far away from an owner’s main residence

If you have a spouse, only one of you can get the deduction for a second home for work. The second home is a rental apartment, an employer-provided dwelling, a right-of-occupancy dwelling or a part-ownership dwelling .

TaxSlayer offers four tiers of tax prep — simply free, classic, premium, and self-employed — but the latter is what really shines. The software supports all major tax situations for free, from unemployment compensation to education expenses to alimony. It is one of the least expensive options on our list, all without sacrificing tax form availability. If you have two different workplaces, you may be able to claim a deduction for the miles you commute between the work sites. The Internal Revenue Service allows you to take this deduction whether you work for two employers or commute between two sites for the same employer. Specific rules apply, however, and you must itemize to take advantage of the deduction.

Deducting Mortgage Interest on a Rental Property

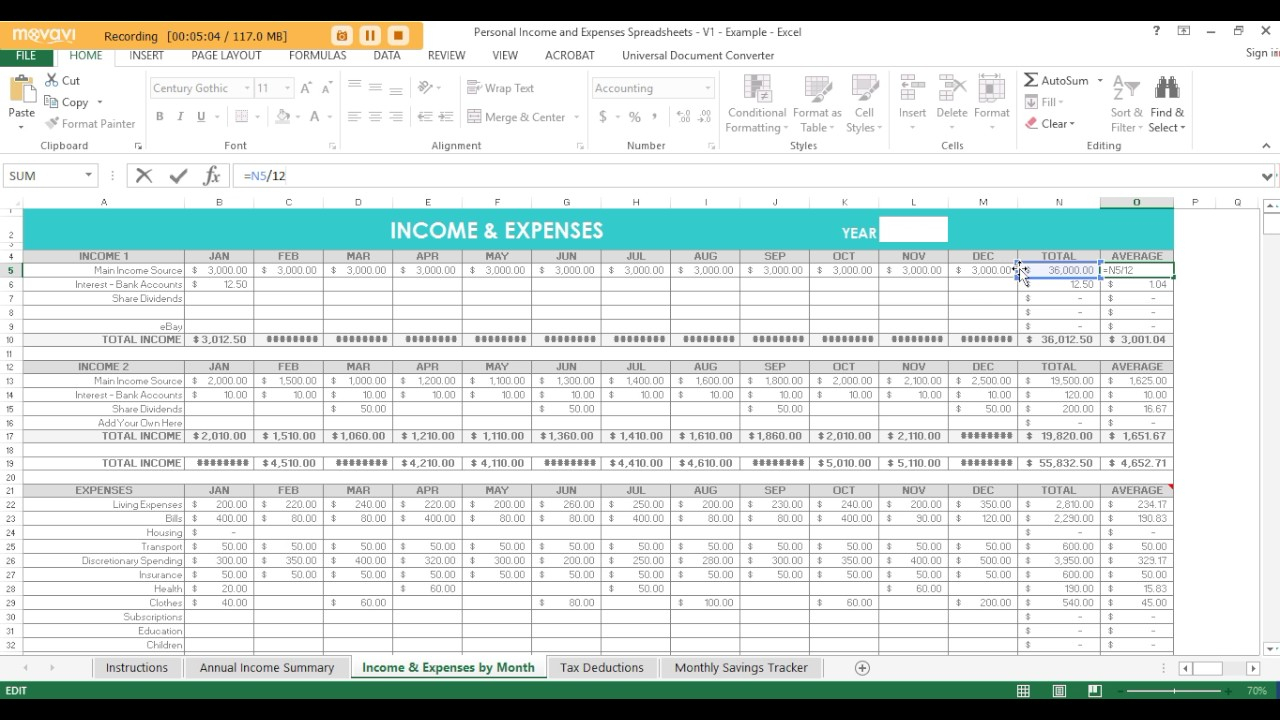

This is an amount of money the IRS allows you to deduct from your income without having to itemize each deduction. For 2022, the standard deduction is $25,900 for joint filers and $12,950 for single filers. This IRS form is then attached to the main 1040 tax return and the work from home expenses are reported on Schedule A, the schedule for itemized deductions. If you pay $10,000 or more in property taxes on your first home, you likely won't be able to deduct any of the property taxes from your second home.

In that case, your house is deemed an investment property and falls under a different set of second-home tax deductions. Investment properties don’t qualify for the mortgage interest deduction mentioned above, but special tax tactics can be applied, like an annual depreciation deduction. Just don’t go overboard — you can get the benefit only if you stay in your second home for more than 14 days, or more than 10% of the number of days you rent it out, whichever is longer. Under normal circumstances, selling a vacation home would require you to pay a capital gains tax on 100% of your profits.

Tax Breaks for Second-Home Owners

Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. If you don’t use the home as a residence, the above rules don’t apply. Report your income and expenses the same as you do for other rental property.

Maybe you bought a far-off hideaway that you’re lucky to visit a couple of times a year. Or perhaps your vacation home is just a quick drive away, and you spend every possible moment there. If you want to spend the off-season making improvements to your hideaway, you can deduct the interest on a home equity loan or line of credit. Renting out a second home means that you'll need to do a little bit more work with keeping track of expenses and income, but it may not necessarily make your tax bill higher. If you rent out your second home for part of the year — even just for three weeks — the tax situation could become entirely different.

You can deduct other rental expenses, including depreciation. However, you can only deduct up to the amount of the income minus the deductions for interest and taxes. Carry over any rental expenses not deductible under this rule to the next year. The TCJA cuts off the deduction for property taxes at $10,000 per return -- $5,000 per return if married and filing separately. Many people who own two homes will max out the property tax deduction from their first home. That means that the property taxes for your second home will not be deductible.

Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. Pathward does not charge a fee for this service; please see your bank for details on its fees. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due.

You have rented a second home because of the location of your primary place of work. At NextAdvisor we’re firm believers in transparency and editorial independence. Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners. Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors. Get all of our latest home-related stories—from mortgage rates to refinance tips—directly to your inbox once a week. Each week, you'll get a crash course on the biggest issues to make your next financial decision the right one.

The part of the gain you can attribute to depreciation is taxed at a maximum rate of 28%. If you used the home for personal purposes and rented it, you must treat the sale as part personal, part business. As previously stated, the maximum mortgage amount to qualify for a deduction is $1,000,000 for married couples whose homes were purchased before December 15, 2017. The amount drops to $500,000 for married couples filing separately. A mortgage interest deduction allows homeowners to deduct mortgage interest from taxable income.

However, the rules changed with the Tax Cuts and Jobs Act of 2017 and the amount that is eligible for a deduction has been reduced. If the second home is considered a personal residence, you must file Form 1040 or 1040-SR and itemize deductions on Schedule A to claim the mortgage interest deduction. Additionally, the mortgage must be a secured debt on a qualified home in which you have an ownership interest. The availability of tax forms is another important factor to consider when choosing tax software. Go with a provider that offers all the tax forms and schedules you need.

If you do so, you'll find that the way you use your property will affect the information you include in your taxes, and what type of second home tax deductions are available. Using the regular method, qualifying taxpayers compute the business use of home deduction by dividing expenses of operating the home between personal and business use. Self-employed taxpayers filing IRS Schedule C, Profit or Loss from Business first figure this deduction on Form 8829, Expenses for Business Use of Your Home. WASHINGTON — During Small Business Week, September 22-24, the Internal Revenue Service wants individuals to consider taking the home office deduction if they qualify.

Comments

Post a Comment